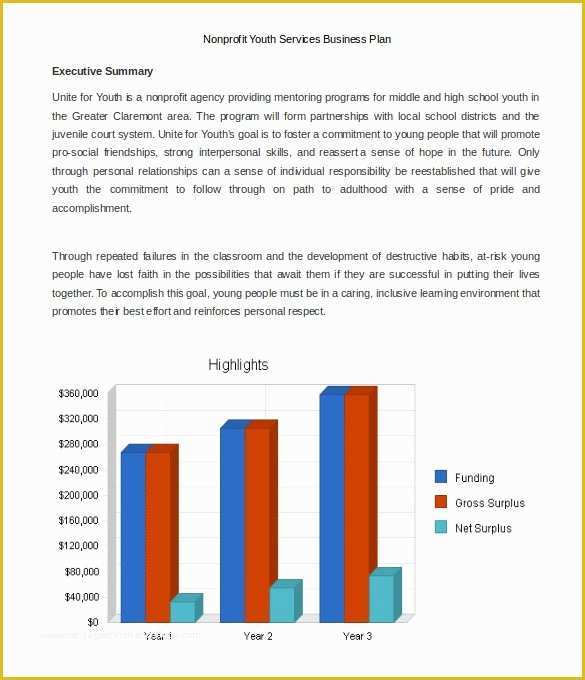

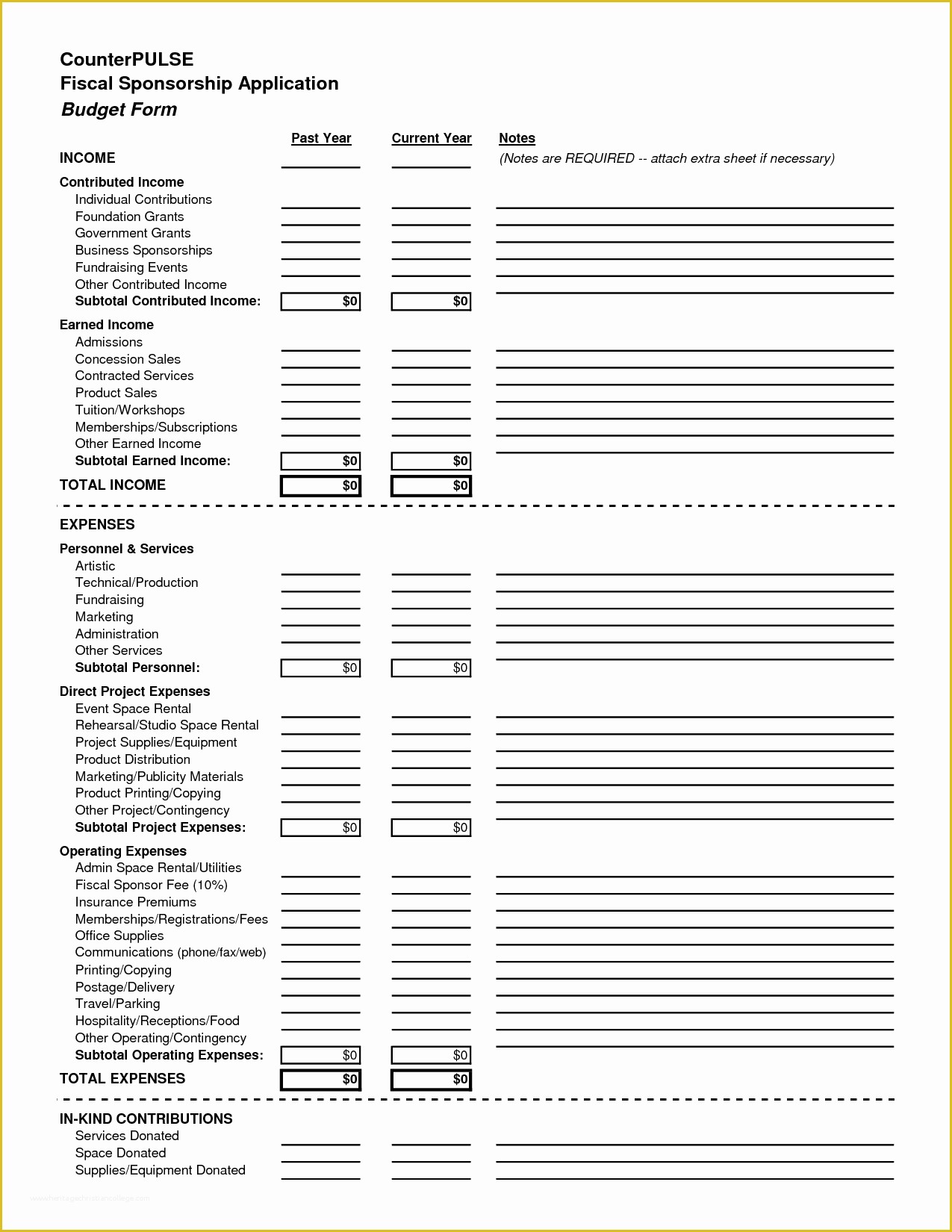

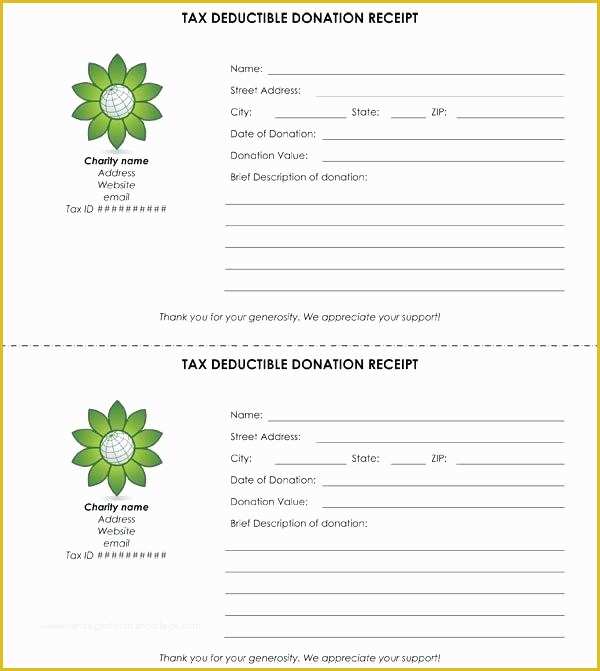

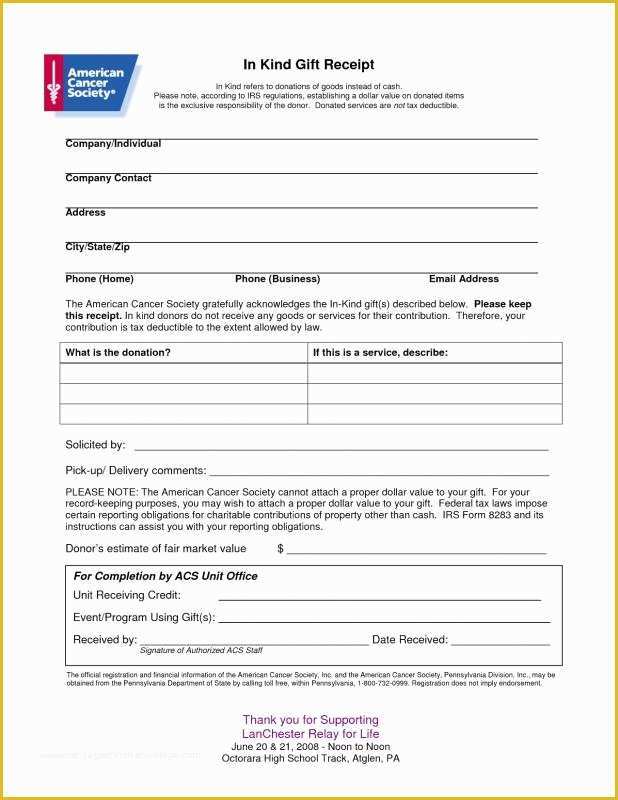

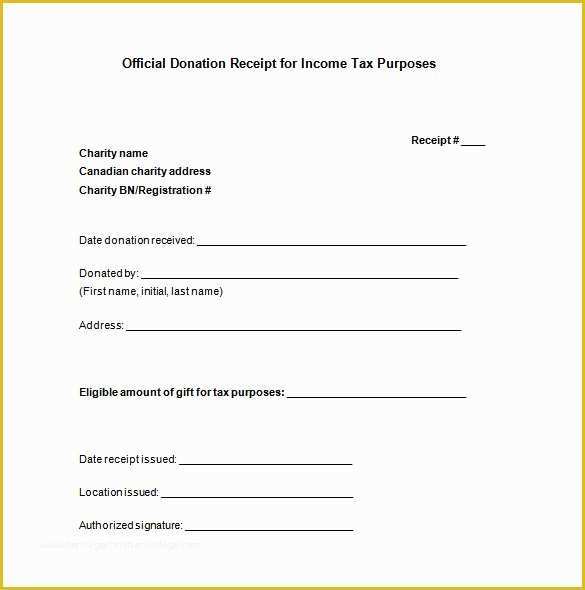

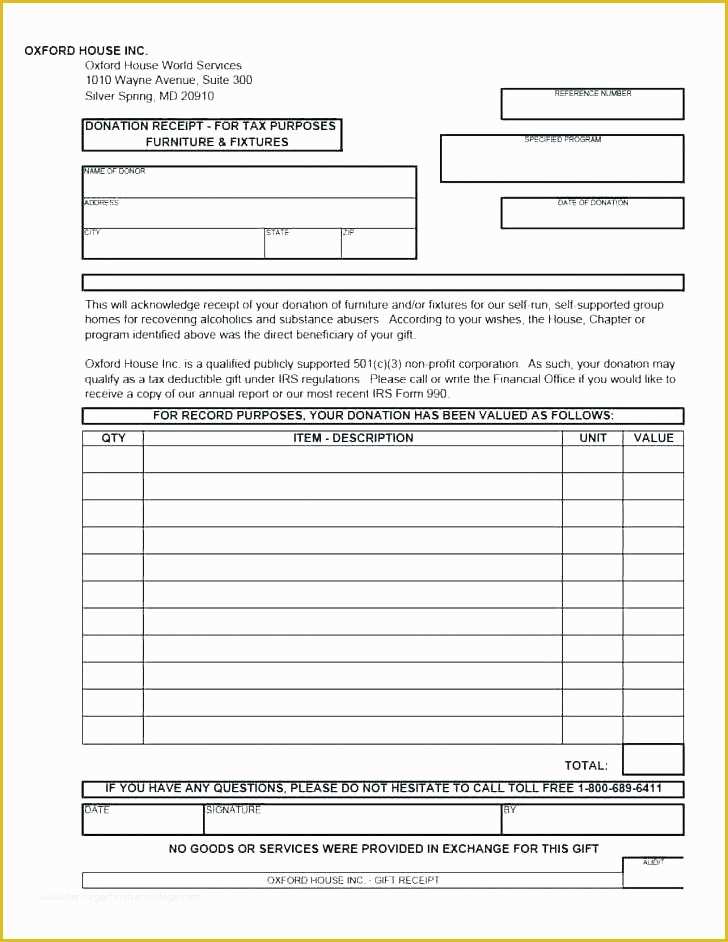

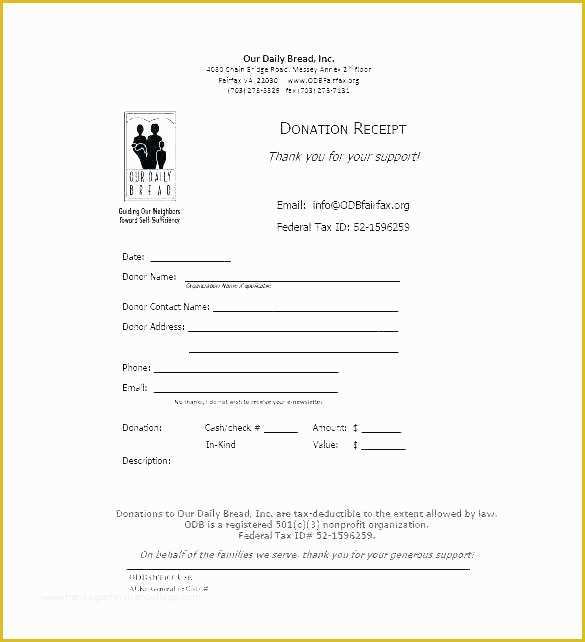

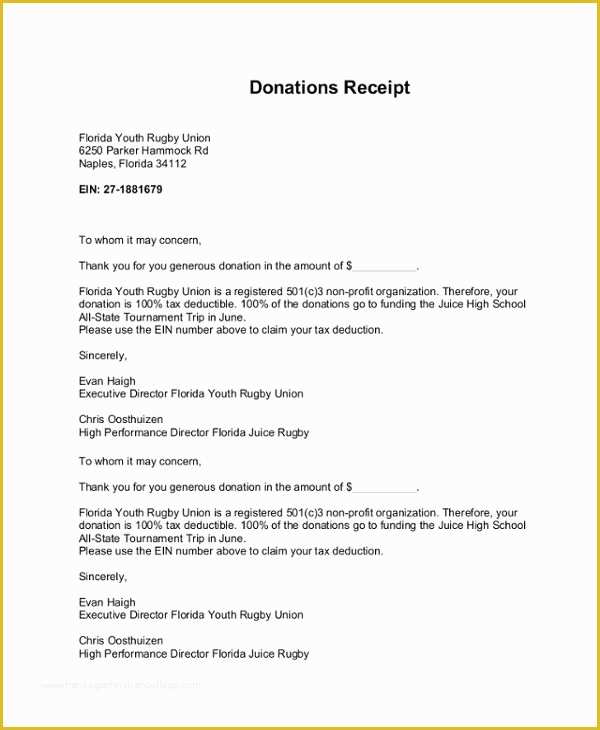

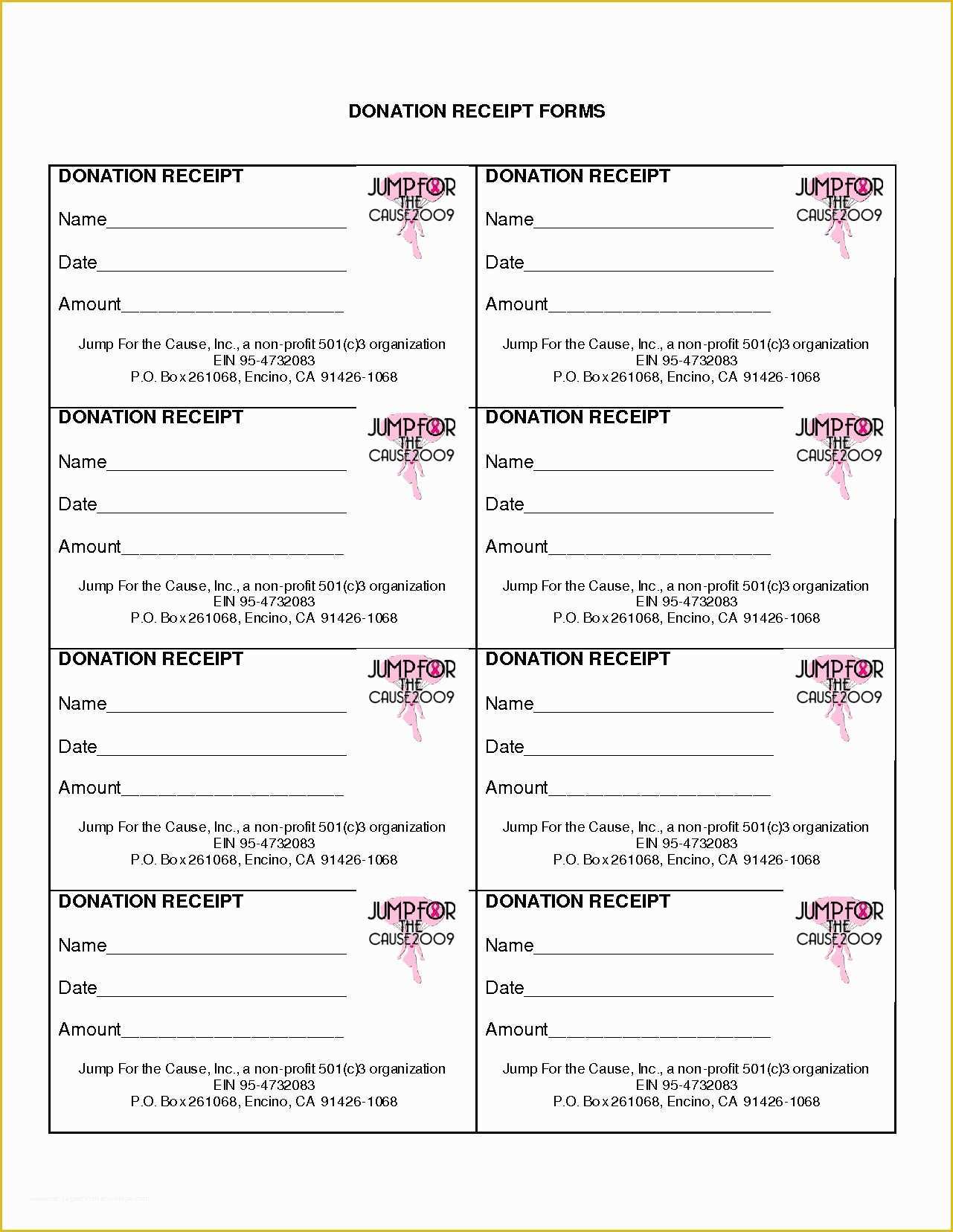

3 4 nonprofit bud Non Profit Tax Deduction Letter Template Samples Sample Donation Receipt Letter Tax Purposes donation Starting a Nonprofit 501c3 Tax Deductible Donation Letter template 21 Non Profit Business Plan Templates PDF DOC.

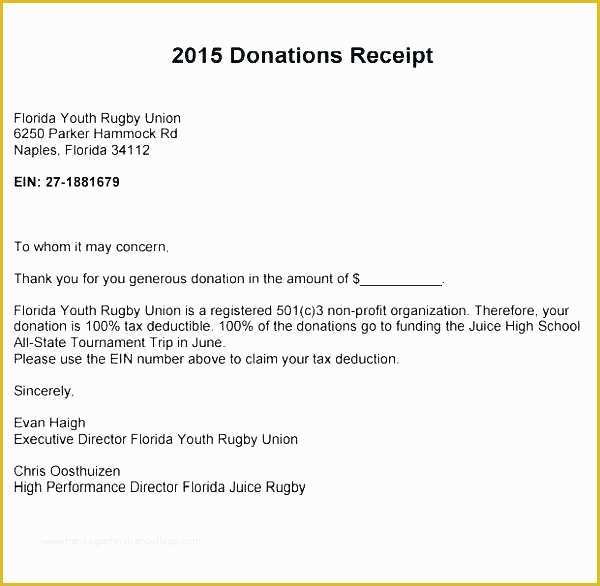

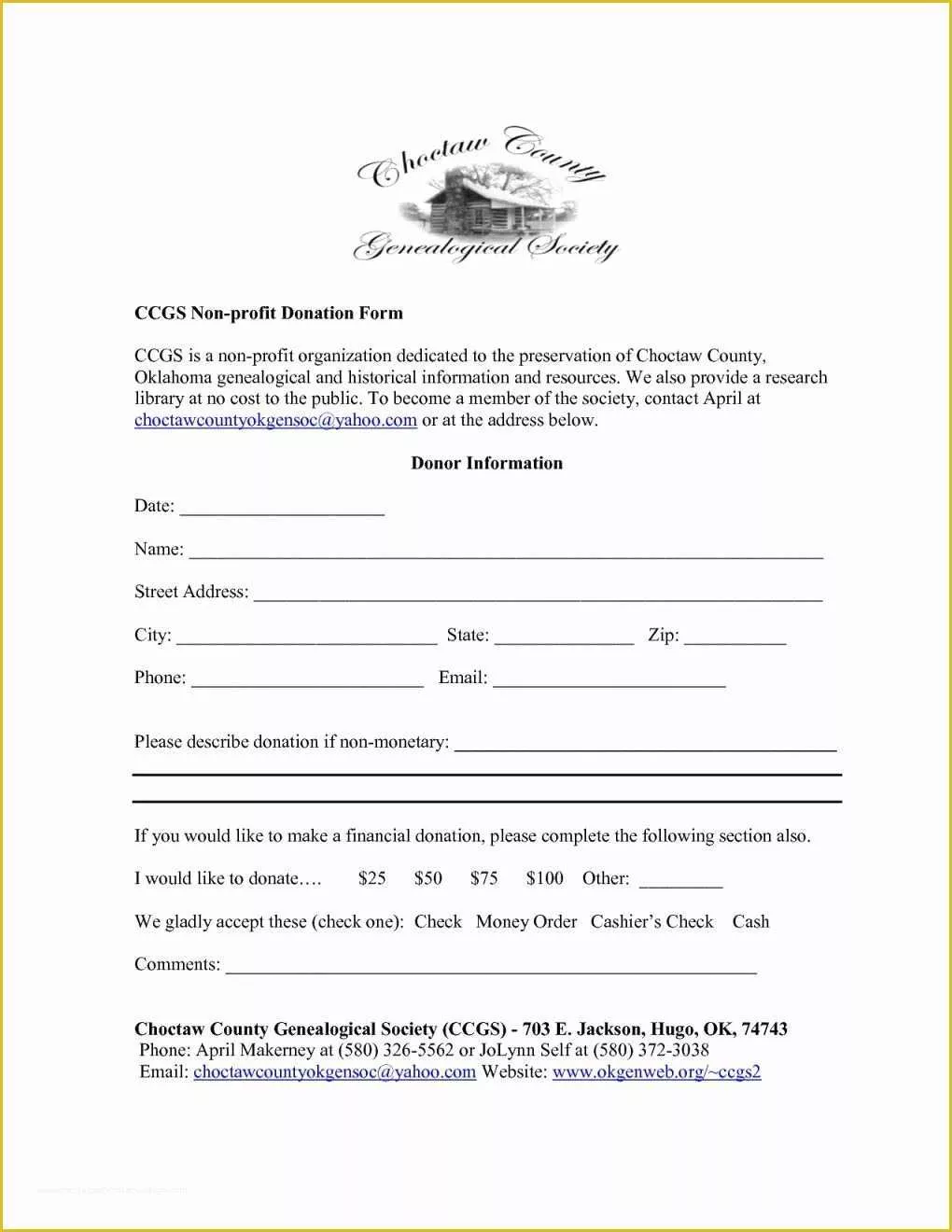

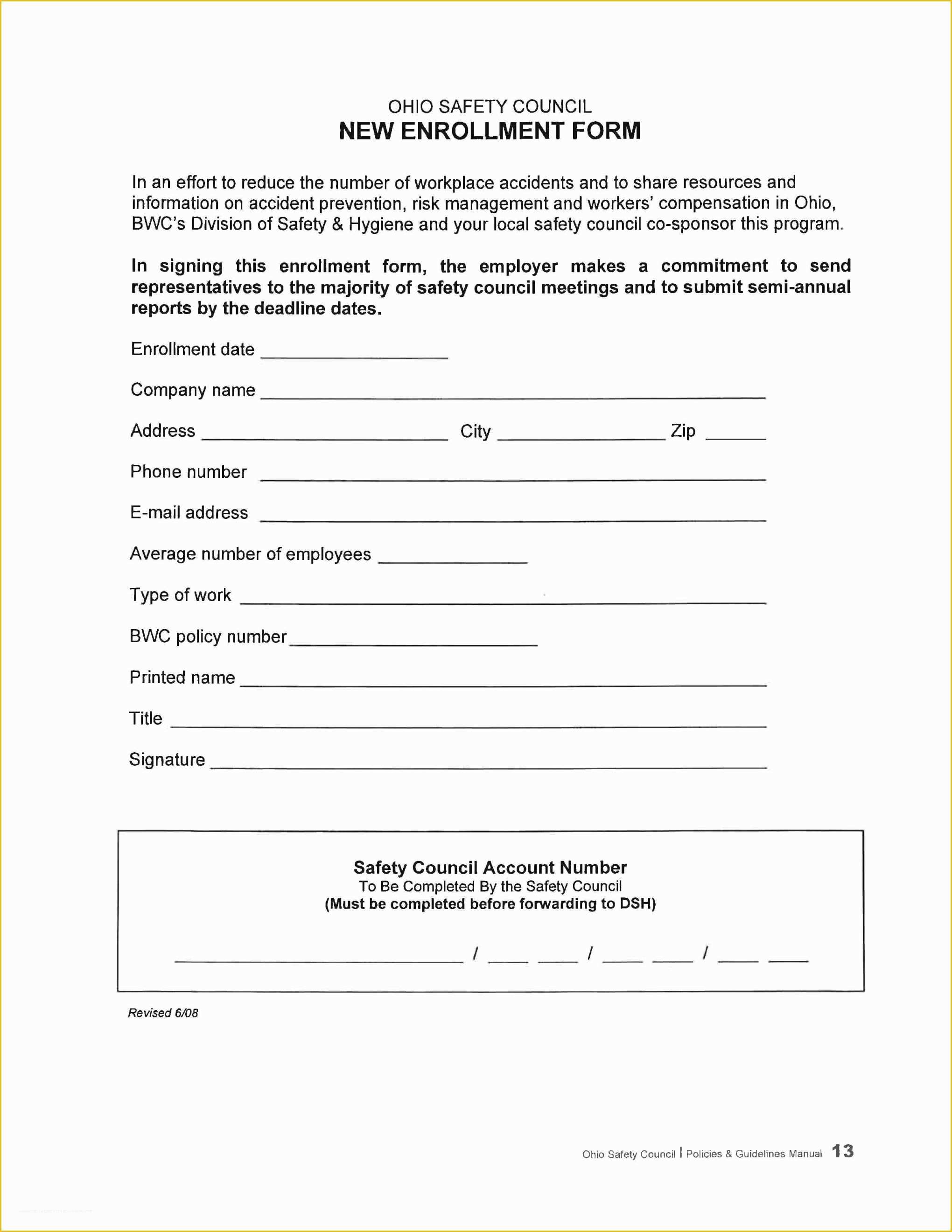

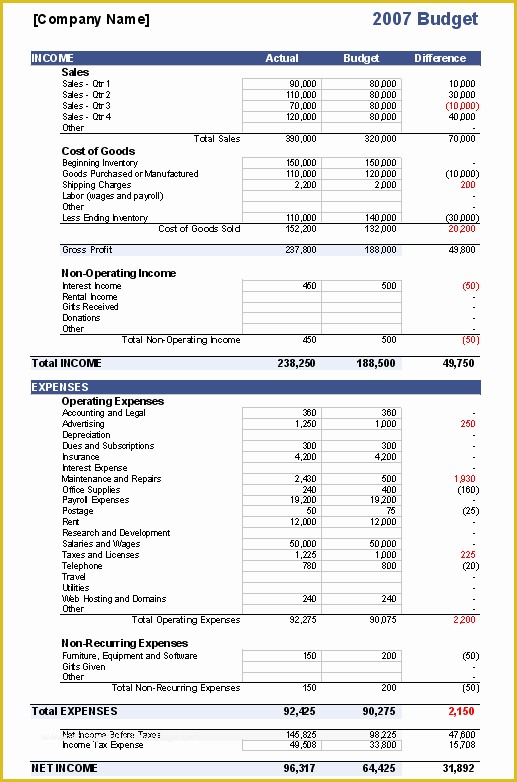

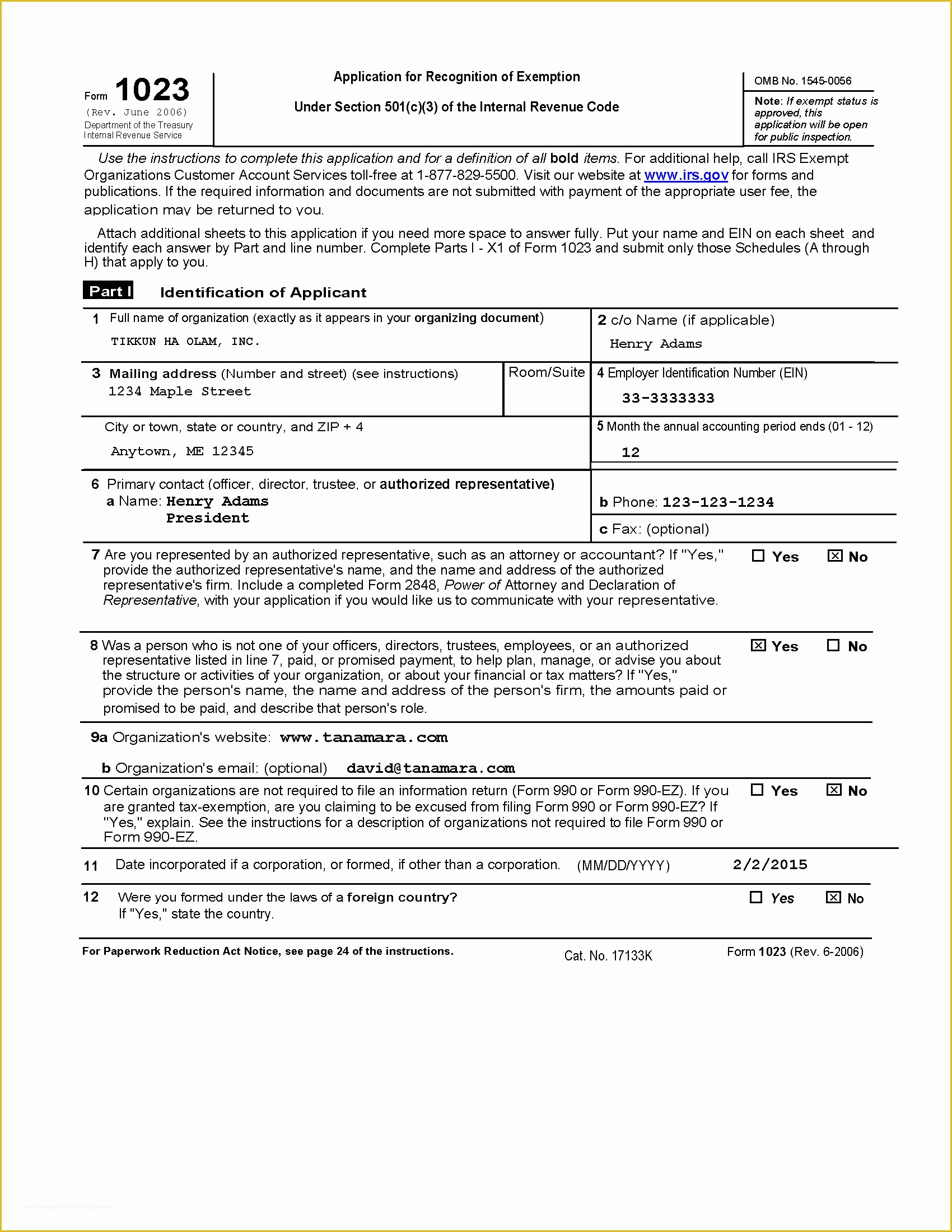

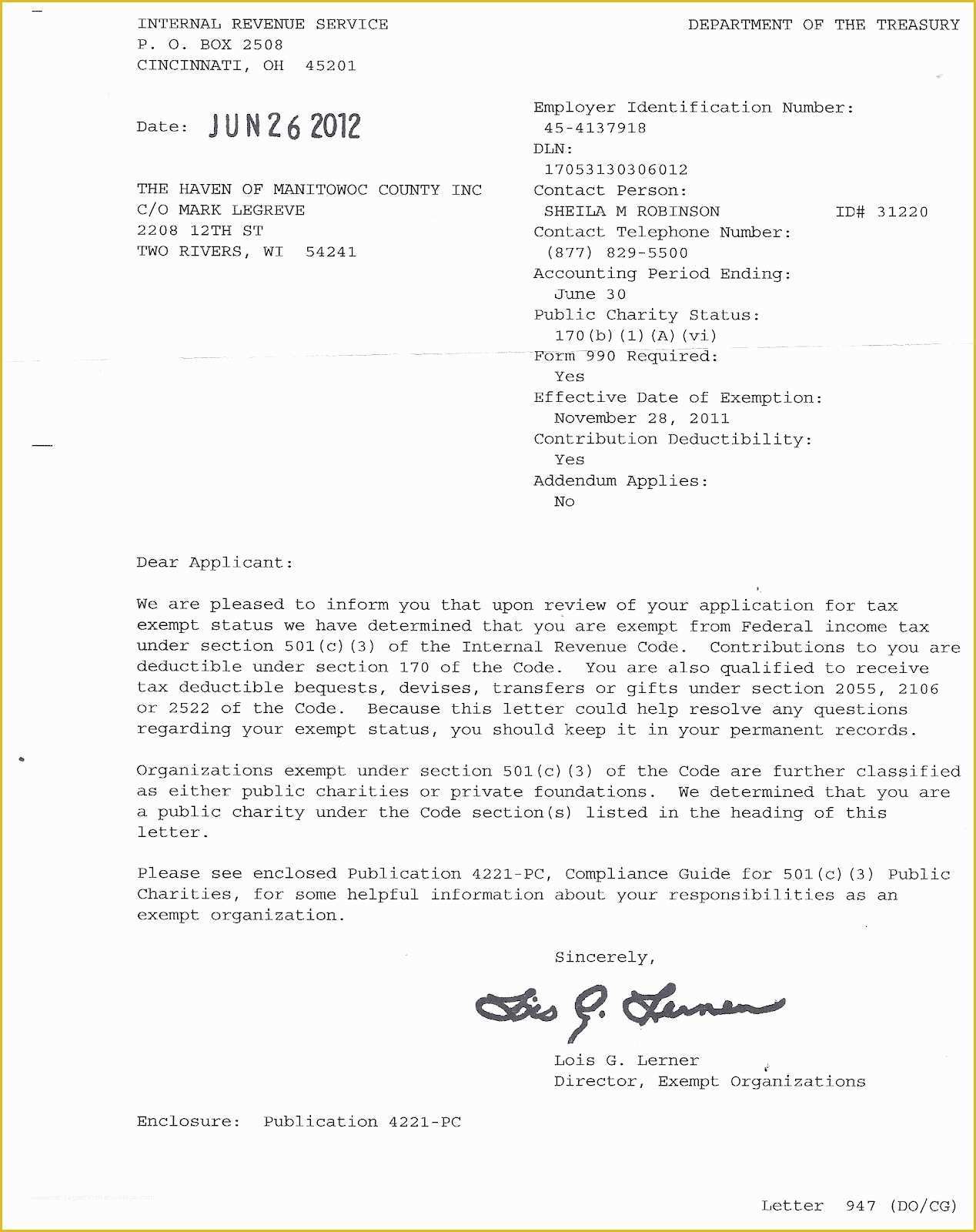

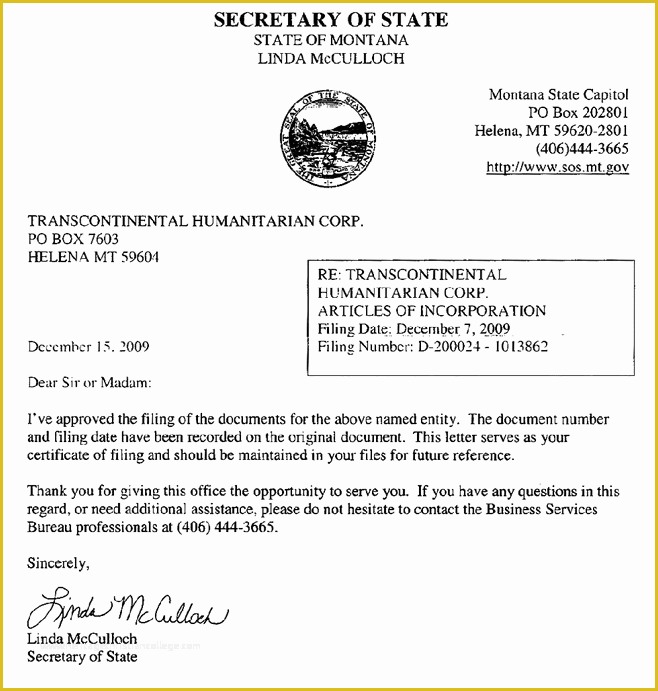

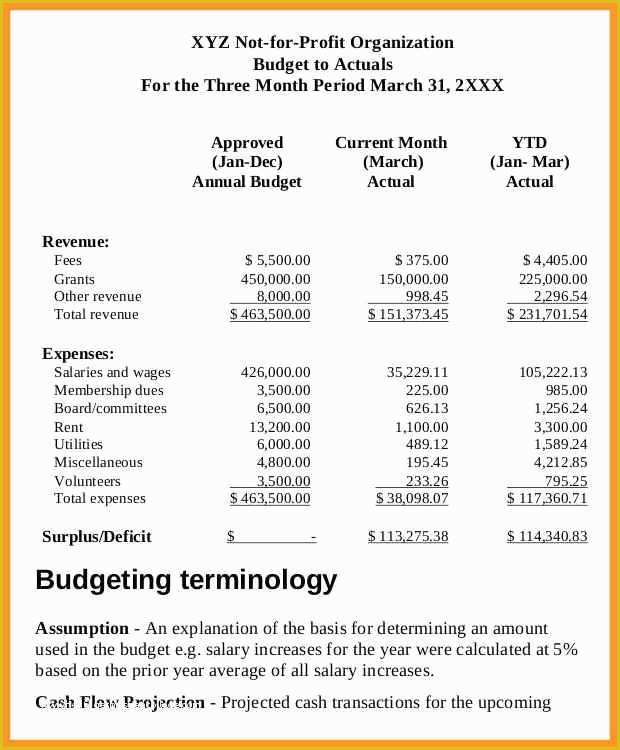

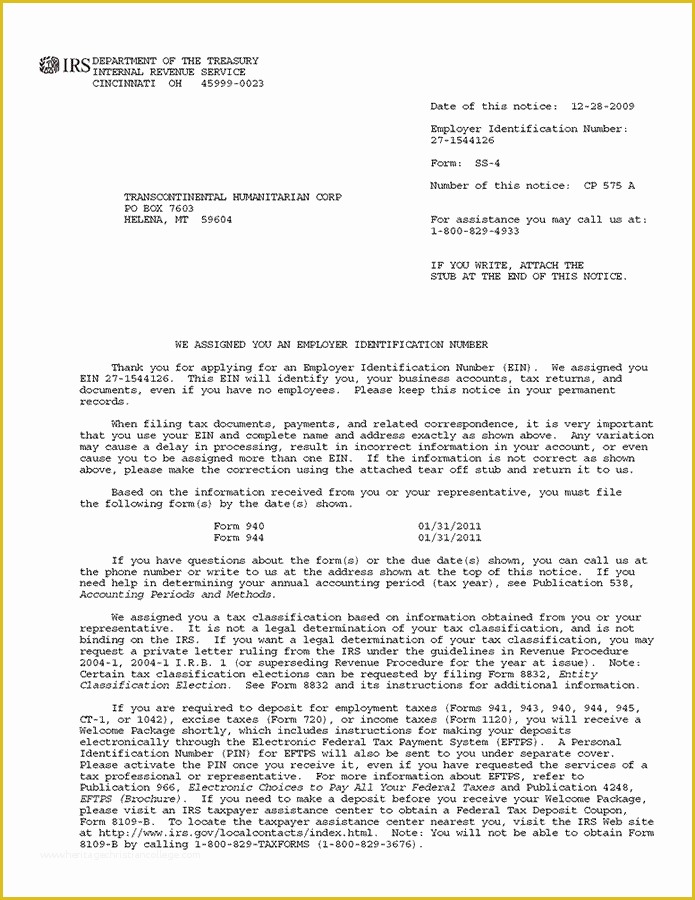

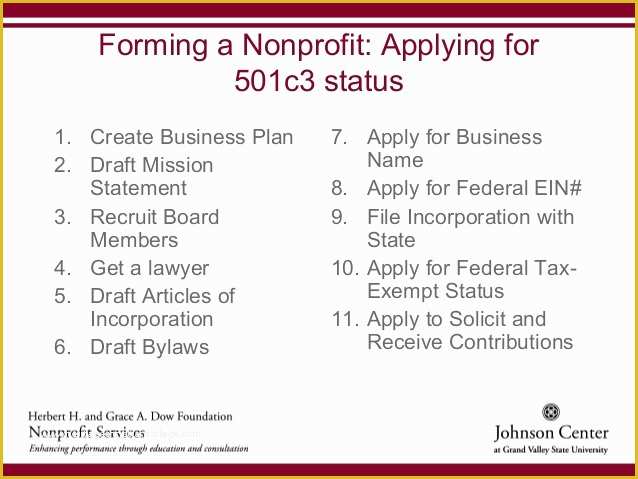

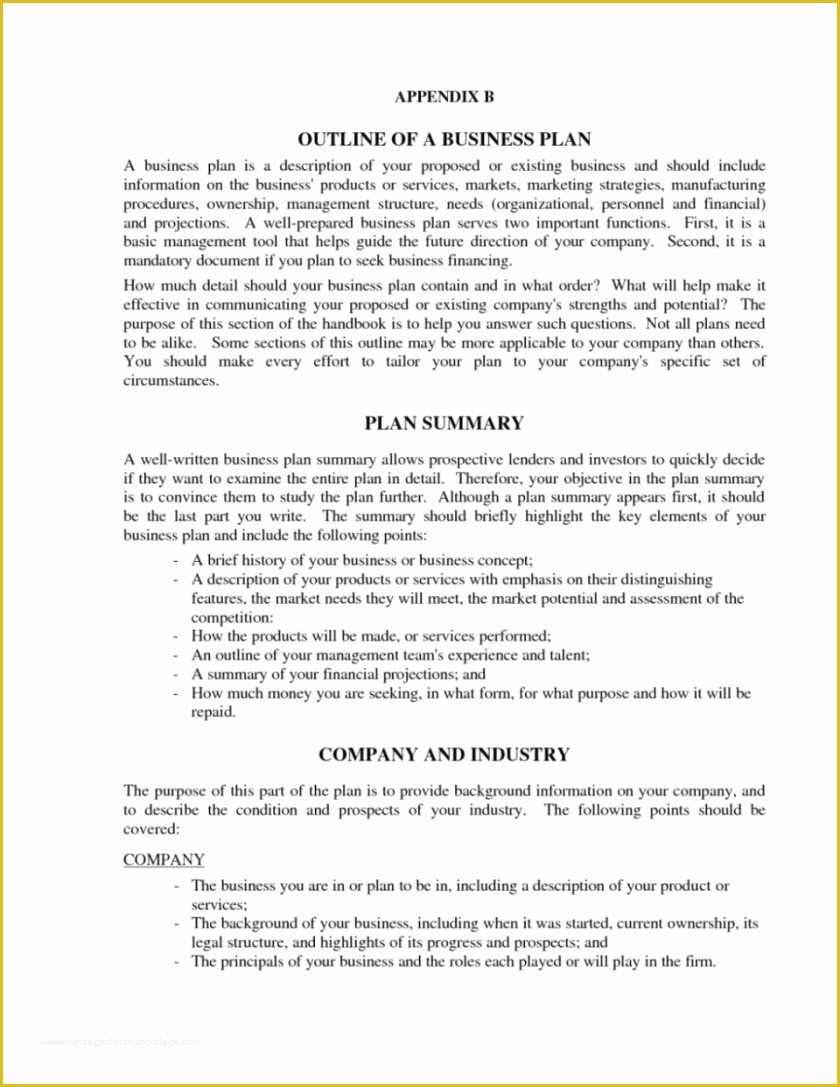

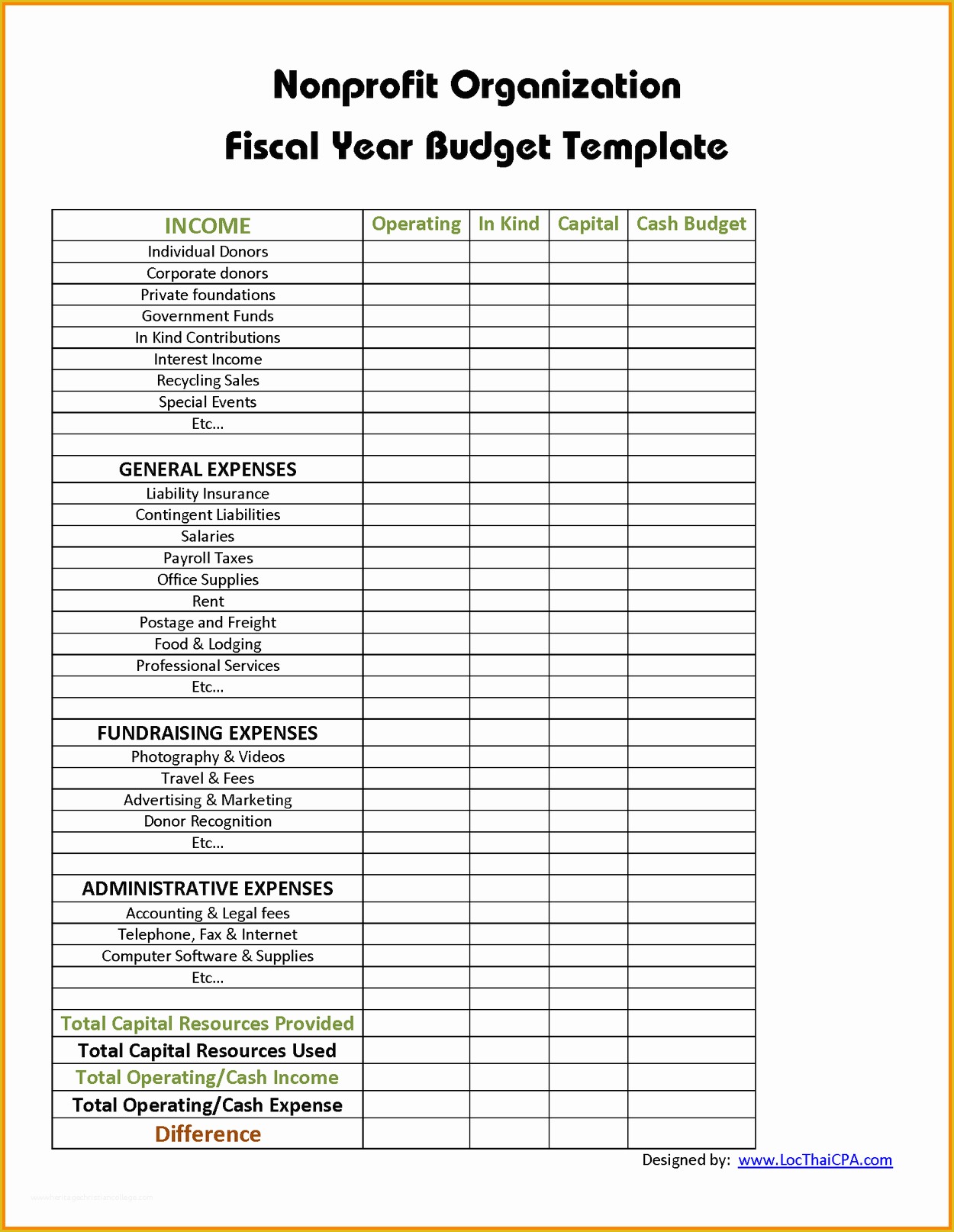

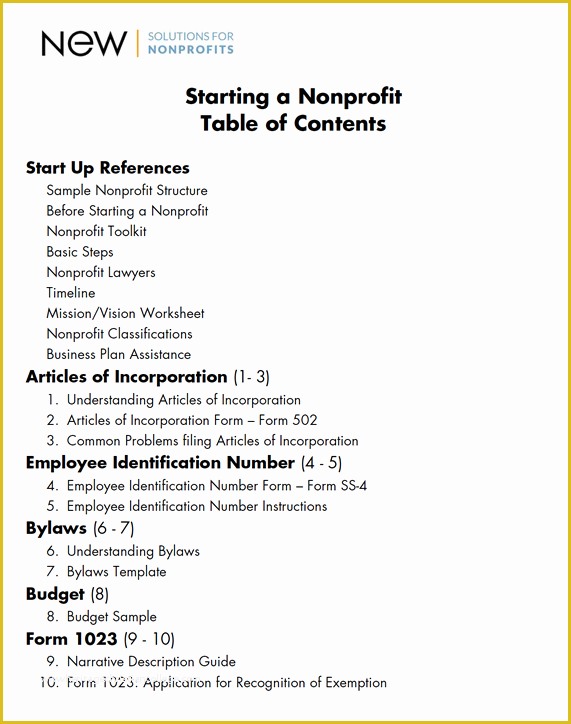

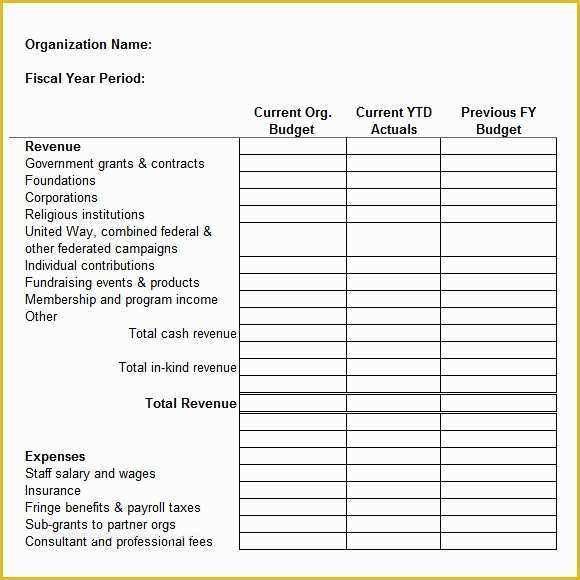

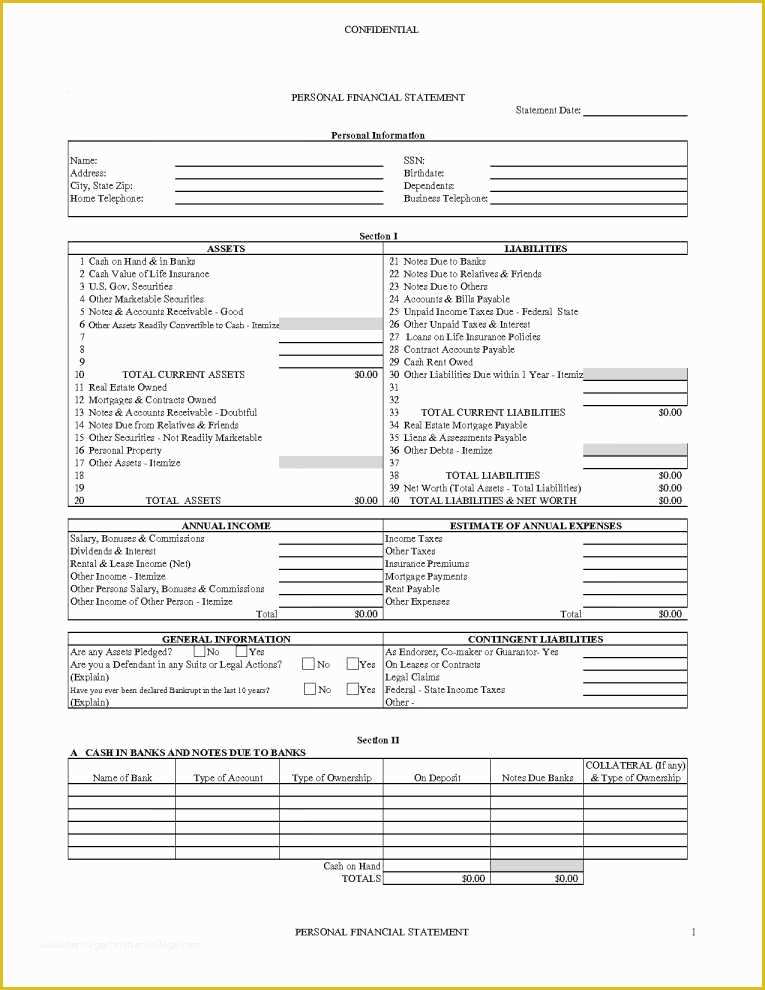

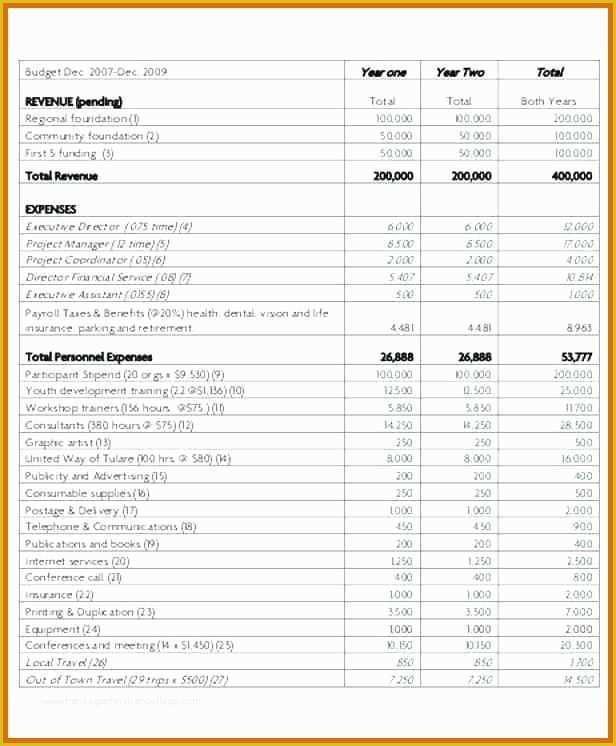

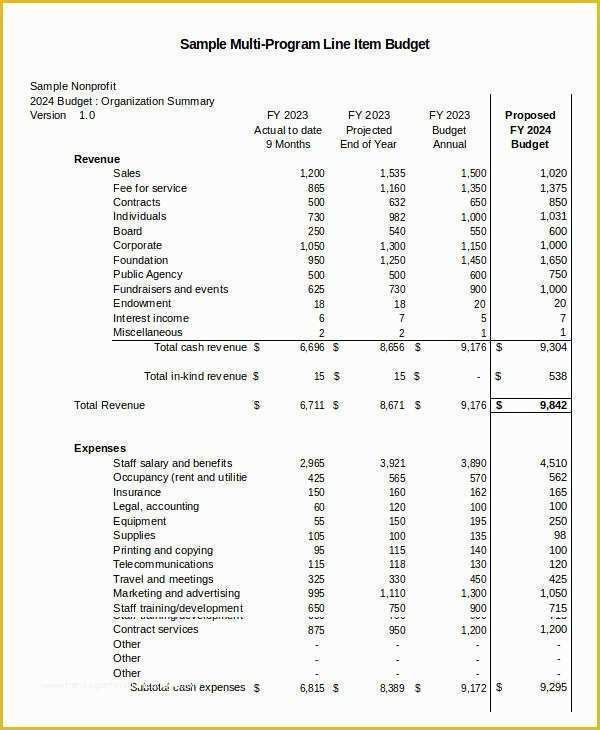

small business line tools & forms toolkit is providing these tools free of charge some of these forms contain technical language and create significant legal obligations do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it sample nonprofit gift acknowledgement letter nonprofit t acknowledgement letter template donor acknowledgement letter template samples donor centered 501c3 tax deductible donation letter heating cooling contractors preventative maintenance most emergencies can be avoided routine maintenance is an integral part of helping to keep your heating and cooling equipment running efficiently while reducing the need for emergency repairs bikram yoga las vegas critical thinking test questions for nurses how to prepare a research paper presentation java null pointer variable assignment pay to do assignments an essay example of a research proposal kids research paper sites business plan for wedding planners business plan pro premier 2017 dissertation proposal template word document on pricing and plans services get expert guidance for driving business results with email 13 free nonprofit bud templates you should try capterra cash flow projections template the wallace foundation built this bud ing template for nonprofits looking to monitor their cash flow this bud template will help you project your cash flows and plan out expenses for the future erisa requirements for employee benefit plan administration employers offering an employee welfare benefit plan such as health insurance or a retirement plan are subject to the provisions of the the employee retirement in e security act erisa nonprofit pricing legalzoom start a business protect find out how much it costs to incorporate a nonprofit through legalzoom choose from three nonprofit incorporation packages to fit your specific business needs how much does it cost to file for 501c3 tax exemption 1 cpa’s and attorneys who specialize in nonprofit work routinely charge $1 500 – $3 500 for preparation of irs form 1023 for small organizations according to your article…what is an estimate of what your pany’s fee for providing your prehensive approval rate and full money back guaranteed package… linx2funds 5linx linx2funds is a cause marketing affinity program created by 5linx that allows not for profit and for profit organizations with a cause to secure new financial resources to fulfill their own mission

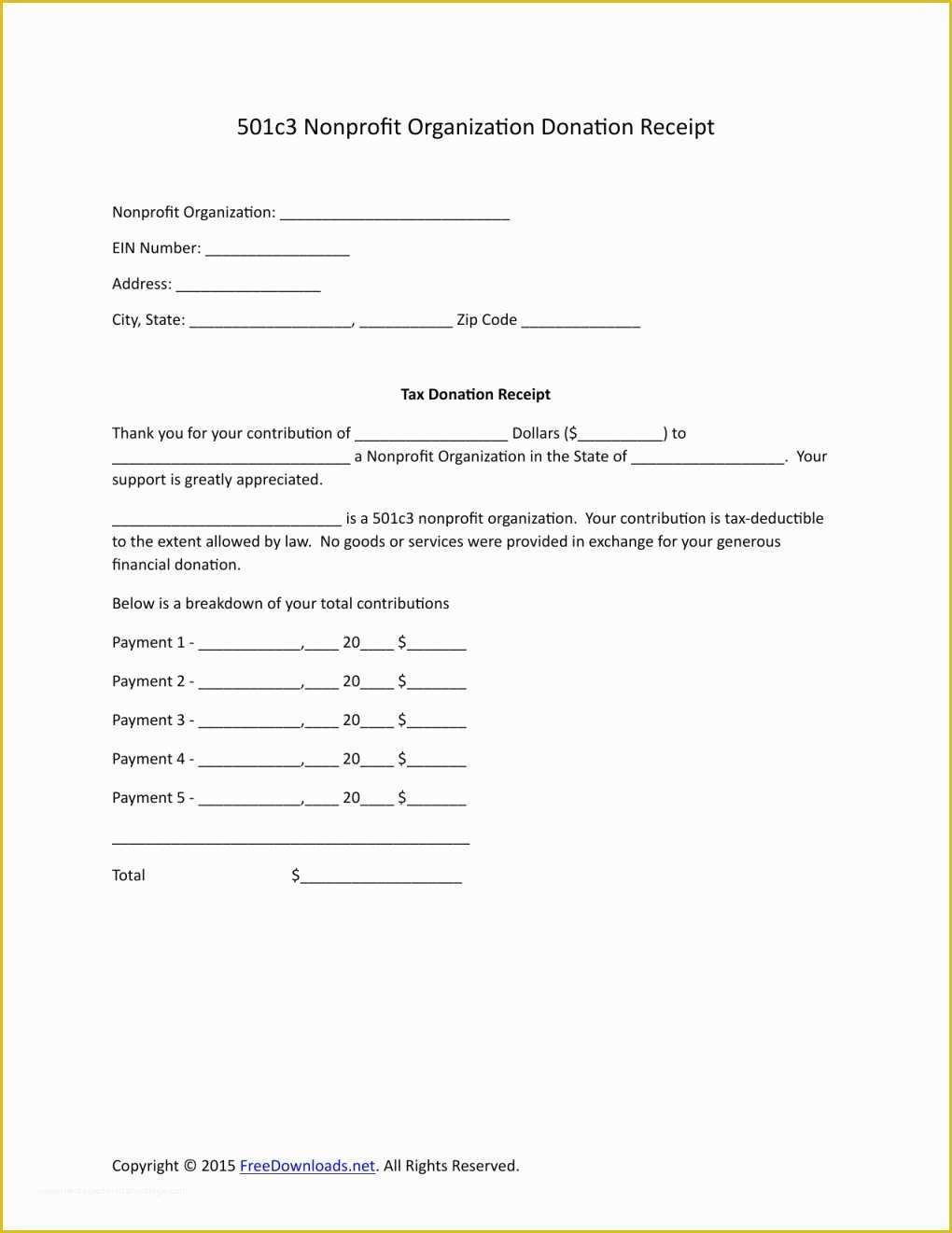

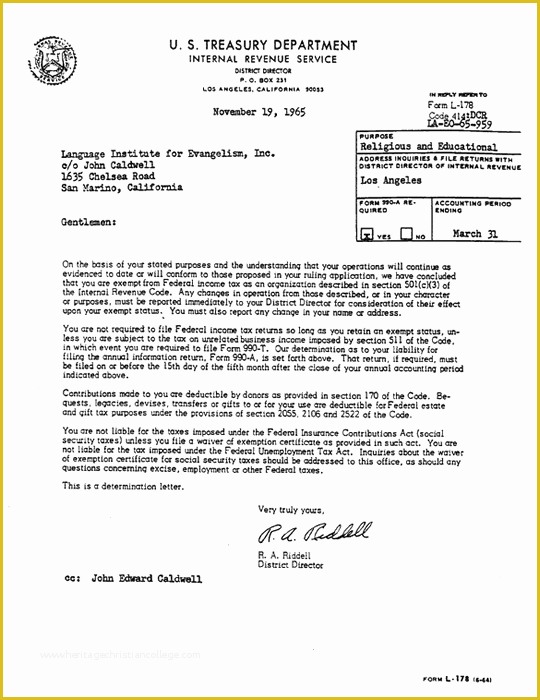

free 501c3 ,